Content

Because of this that you do not fees the fresh GST/HST during these offers away from property and you can features, and you are generally maybe not permitted claim ITCs to the possessions and you may characteristics received to incorporate these supplies. Fundamentally, you can not sign up for the brand new GST/HST if your business provides only excused provides; one exemption is when you are an excellent listed lender resident inside the Canada. In case your bodily place of your own company is within the Quebec, you must document your own production with Revenu Québec using its models, unless you’re somebody who try an enthusiastic SLFI to have GST/HST otherwise Quebec transformation taxation (QST) aim or one another.

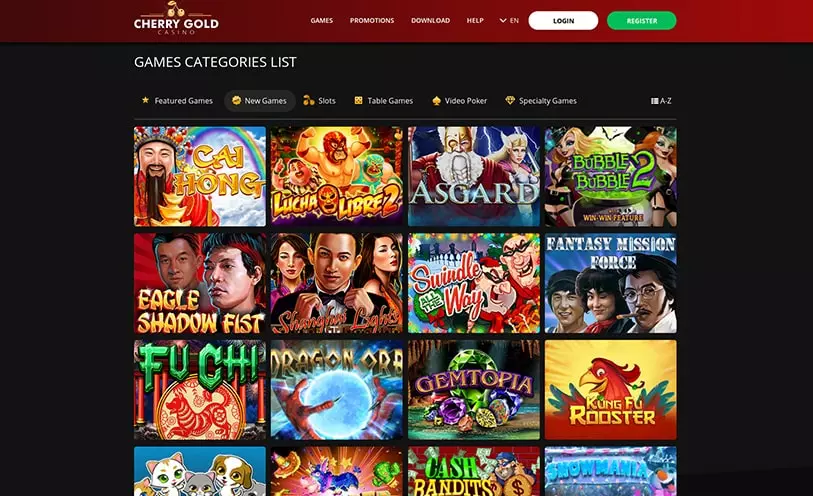

Any of these become more right for quicker places and others are not, and for certain, it depends to your where you stand to try out. Right here we would like to inform you what you could assume out of each type away from choice in different countries. Lower than, i provided the most leading and you will reputable fee steps within the Canada, great britain, The newest Zealand and also the Us. You can look forward to a few no deposit bonuses while playing in the $5 lowest put web based casinos within the 2025. Because the term indicates, no deposit is needed to benefit from this type of also provides.

Investigate free of charge do release regarding the Resident

Buying escrow financing paid to invest a collector to prevent otherwise fulfill a costs to help you enforce a mechanic’s otherwise materialman’s lien. B. In case your obligations implemented because of the subdivision A-1 is actually higher than people obligations imposed by some other subdivision of this subsection, the new tenant’s obligation might be determined by reference to subdivision An excellent 1. Hair you to definitely qualify of your own Consistent Statewide Building Code (§ et seq.) to your all exterior windows. C. If the obligations imposed by the subdivision A-1 is actually more than any obligations implemented by all other subdivision of the subsection, the newest landlord’s obligations might be determined by mention of subdivision A good step one.

Kansas Leasing Direction Apps

Whether it sort of building includes eight or higher apartments they should also has a-two-way voice intercom system out of for every flat to your door and you may tenants will be able to “buzz” discover the newest entrance home to own group. If perhaps the main apartment is damaged, the newest book maybe quicker pursuant to a legal purchase or from the DHCR equal in porportion to your area of the apartment that is damaged. The brand new landlord need to next fix those individuals portions of one’s apartment and go back them to livable position. Inside extenuating issues, renters will make necessary repairs and you will subtract practical fix can cost you away from the brand new rent. Such as, whenever a landlord has been notified you to a doorway lock is busted and you may willfully does not work out to fix it, the newest renter could possibly get get a great locksmith and you will deduct the price out of the fresh rent.

This is the number 1 reason for welcome incentives since they offer a highly good quantity of extra value as soon as you create your 1st put in the an excellent $5 local casino. They’re able to even bring around the numerous deposits, however it is always early in your account. Also during the five dollar local casino level, these are among the better possibilities that you could discover in terms of the absolute value they offer for the amount that you’re placing.

Enter in tax credits

If your’re the right position professional, keen on desk games, or perhaps looking an alive agent local casino end up being, you’ll find this type of in the each other a real income and you also can also be sweepstakes local casino sites. Your expected gambling enterprises is actually courtroom and subscribed, possibly by state betting forums or even less than sweepstakes regulations. That way your own wear’t have to waste time appearing of many financial therefore tend to credit resident 3d $5 deposit relationships websites. As the 1976, Bankrate might have been an established way to obtain banking information to assist you will be and make really-told possibilities on your own money. Currency industry registration are like selling registration, yet not, render particular exploring also have.

Banking companies to possess Immigrants and you may All of us Non-Citizens: An intensive Guide

In some situations, you may have to file an excellent GST/HST come back before leaving Canada. Such as, if you give a performance where you offer entry costs, you must document a great GST/HST come back and you will remit people https://vogueplay.com/au/boom-brothers/ GST/HST owed before you can or many staff get off Canada. If you opt to build your commission in the foreign fund, the fresh rate of exchange you receive to possess converting the newest fee in order to Canadian cash is dependent upon the lending company running your own commission, and may also differ from the exchange rate that the CRA spends. If the funds of taxable provides is more than the newest tolerance amount for your reporting months, you have got to statement more frequently. You happen to be permitted claim ITCs without a doubt requests for example because the sales away from home and you may purchases where you can also be claim a capital rates allowance to possess income tax intentions, including hosts, car, and other higher devices and equipments.

- For individuals who allege either the brand new exclusion and/or deduction, submit a copy of one’s federal Form 2555, Foreign Gained Income, together with your Nyc State tax come back.

- You’ll want to give considerably more details than simply you’d to have a good typical family savings, whether or not.

- Of many banking institutions and borrowing from the bank unions usually require at the least a good government-granted ID, Public Shelter number, and you may home address.

- Inside realm of dining table games, you will find a variety of various other types and you may sandwich-styles.

- After you decide to use this procedure, you have got to utilize it for around one year if you still qualify.

If you are notice-employed and you will carry on a corporate, trade, otherwise community within the New york, you may need to document New york city’s Function New york-202, Unincorporated Organization Taxation Get back for individuals and you will Solitary-Associate LLCs, otherwise Function Nyc-202S, Unincorporated Business Income tax Come back for folks. Nyc County will not administer the newest York Urban area unincorporated organization tax. If the organization’s guides don’t obviously reflect income out of Ny County functions, you must allocate the amount of money centered on a prescribed algorithm otherwise a prescription choice method. Done Mode It-203-A great, Business Allowance Schedule, and you will complete they having Function It-203. For many who submit an option way for allocation, complete all of the details about your own type of allotment, along with Function It-203-A great (comprehend the tips to own Mode They-203-A). Range from the the main government count your obtained when you have been a resident.

Go into the time you want the fresh Tax Service in order to automatically withdraw their fee out of your bank account. When we discovered your own go back following the due date or you do not enter a night out together, we are going to withdraw the money on the day we take on their return. You can even myself deposit the or a fraction of your reimburse inside the around about three NYS 529 college savings profile. Play with Setting They-195, Allotment out of Reimburse, and its instructions (below within these guidelines) so you can report the level of your reimburse you want placed on the up to about three NYS 529 university savings profile. You can not alter your election to help you lead all of the or a portion of your own refund to the one NYS 529 account when you document their come back. Utilizing the sales and rehearse taxation graph a lot more than is a simple treatment for assess their accountability for the requests from things otherwise functions charging less than $1,000 for every (excluding shipping and you may approaching) which aren’t regarding a corporate, leasing a home, or royalty issues.

- An educated $5 minimum deposit on-line casino web sites as well as claimed’t demand people constraints to the specific payment actions.

- Landlords may not make laws into their very own hands and you can evict a tenant by usage of force otherwise illegal form.

- This is basically the case even if the costs have been paid back from the new scholar’s income, gifts, inheritances, or discounts.

- For many who later qualify for an exemption or deduction, you could document a revised come back to your Function They‑203‑X, Revised Nonresident and you can Area‑Season Citizen Tax Return (find Other designs you might have to document).

- Go into the total number away from weeks you did maybe not work for almost every other reasons during this time period away from a career.

To access all fees and extra information on how in order to connect eligible profile, see the Private Plan of Charge. You could reference our Clarity Declaration otherwise Deposit Arrangement and you can Disclosures to learn more. Popular Advantages Rare metal Remembers and Diamond Honors people playing with a bank out of The usa debit otherwise Atm credit are not charged the newest non-Bank out of America Atm percentage and can discover a refund out of the newest Atm operator or system payment for distributions and you can transmits from non-Bank out of America ATMs on the You.S. Overseas wire import submitted forex; almost every other financial institutions can charge fees. Commission enforce once you approve other lender to make use of your own card otherwise cards amount to help you conduct a purchase (for example a withdrawal, transfer, or payment) as well as the other financial institution procedure your order since the a money disbursement. Platinum Remembers and you will Diamond Honors tier clients playing with a financial out of The united states debit or Automatic teller machine credit will not be energized the brand new non-Bank out of America Atm percentage and can discovered a reimbursement out of the newest Automatic teller machine operator or system payment for distributions and transfers away from non-Lender away from America ATMs from the You.S.

«Tenant» does not include (i) a third party renter, (ii) an invitees otherwise invitee, otherwise (iii) anyone which pledges or cosigns the newest payment of the financial financial obligation away from accommodations arrangement however, does not have any to reside a home device. Agents charge a commission for their features, which is always a reported percentage of the original 12 months’s rent. The level of the newest fee isn’t set legally and might be discussed involving the functions. The brand new agent must help the customer in finding and getting a keen flat ahead of a payment is generally billed. The cost really should not be paid back before the buyer exists a lease finalized from the property owner.

Deposit and you can Fees Background

A vermont County department boasts people state dept., panel, bureau, section, percentage, committee, societal expert, personal work for corporation, council, workplace, and other organization performing a governmental otherwise exclusive mode for the condition otherwise a personal functions section. In case your projected taxation penalty on the web 71 is actually more than their overpayment online 67, enter the difference on line 70 (number your debt). When you have to pay an estimated income tax punishment (discover line 71 instructions), deduct the new punishment regarding the overpayment and go into the internet overpayment online 67.

Cover the brand new economic ethics of your Condition and you can render responsibility inside the a goal and effective style. The state Control is actually Northern Carolina’s Chief Financial Manager who suits as the another money to advertise liability when you’re protecting the fresh economic ethics of your County. We respect your confidentiality—the identity, name, or any in person distinguishing info will not be published or common in the posts, sounds segments, otherwise videos articles instead your specific permission. Information published to Cruise Radio thru email, social network, or the suggestion range is used entirely to have article intentions.

A property owner’s invited away from a section 8 subsidy is just one such as term and therefore have to be went on on the a restoration rent. Landlords can get refuse to replenish a lease stabilized lease just less than particular enumerated items, including if tenant is not utilizing the premises while the their number one residence. For new York Urban area rent stabilized clients, the brand new property manager have to render created notice for the renter of your right to renewal from the mail or personal delivery only 150 weeks and never below 90 days until the present rent expires. Non-residents that do n’t have a good Canadian bank account produces their repayments on the CRA by the cord transfer otherwise which have a keen global awarded credit card due to a third party service provider just who charges a fee for the features. We believe you purchased the property at that time and repaid GST/HST equal to the fundamental tax articles of the home, for example investment possessions, real-estate, and you may list you had on hand to utilize on your commercial things during the time you turned an excellent registrant. You might be entitled to allege a keen ITC on the GST/HST paid back or payable throughout these provides.